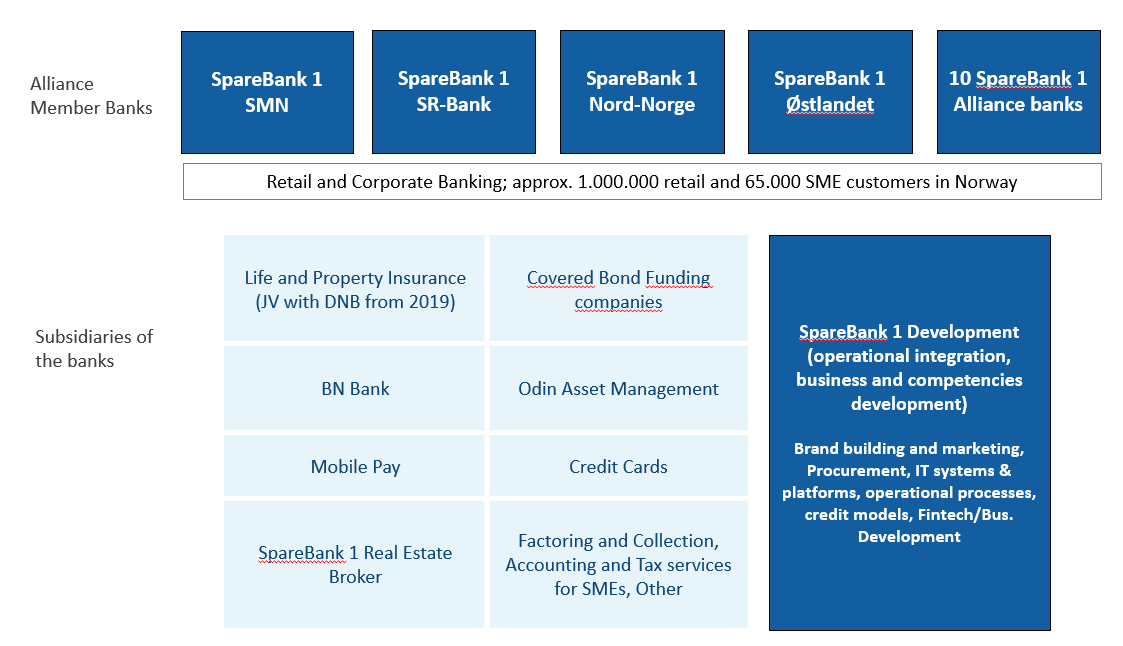

The Alliance is a banking and product collaboration in which the SpareBank 1 banks in Norway closely cooperate. An overarching goal for the SpareBank 1 Alliance is to ensure the independence of the individual banks, and regional presence through strong competitive ability, profitability and financial strength. At the same time, the SpareBank 1 Alliance represents a competitive complete banking alternative at national level.

Founding banks were SpareBank 1 Midt Norge, SpareBank 1 Nord-Norge and SpareBank 1 SR-Bank

The SpareBank 1 Banks coordinate: Brand Building/Marketing, IT Operations and Systems Development, Risk Management and modelling, Centres of Excellence.

Today the SpareBank 1 Alliance consists of 14 banks, who jointly own one further banks (BN Bank), so that in total there are 15 originators of the mortgage loans in the cover pool of the mutual covered bond issuer, SparBank 1 Boligkreditt. The Alliance also canalize a lot of its mutual interests through SpareBank 1 Gruppen AS, a holding company of life and non-life insurance, mutual funds, a broker-dealer and other companies.

The SpareBank 1 Alliance is collectively one of the largest providers of financial products and services in the Norwegian market. The alliance has established a national market profile and developed a unison brand. The platform forms the basis for common product and business development amongst the Alliance banks.

The purpose of the SpareBank 1 Alliance is for SpareBank 1 banks to develop and supply competitive financial services and products and to achieve economies of scale. The individual alliance banks are long standing independent financial institutions in Norway, most of which can trace their history back to the middle of the 19th century.

The main functions of the Group entity within the SpareBank 1 Alliance are twofold:

1. Operate and develop the production and delivery of competitive products and services for distribution among the alliance banks, other banks with distribution agreements with companies in the SpareBank 1 Gruppen and LO. This work is organised in SpareBank 1 Gruppen AS.

2. Operate and develop the alliance partnership with common administration, development and implementation of activities that give economies of scale and spread of expertise. This work is organised in the SpareBank 1 banks' company Alliansesamarbeidet SpareBank 1 DA, which provides the administrative superstructure for the alliance. The company administers financing and ownership of the applications, concepts, contracts and brand on behalf of the participants in the alliance.

The SpareBank 1 banks operate exclusively in Norway.

Northern Norway is the geographical region of Norway, consisting of the three northernmost counties Nordland, Troms and Finnmark, in total about 35% of the Norwegian mainland. As of the 2nd quarter 2013 the population of the region was 475,000 approximately 9.4% of the Norwegian total. Some of the largest towns in Northern Norway (from south to north) are Mo i Rana, Bodø, Narvik, Harstad, Tromsø and Alta. Northern Norway is often described as the land of the midnight sun and the land of the northern lights. Further north, halfway to the North Pole, is the Arctic archipelago of Svalbard, traditionally not regarded as part of Northern Norway. SpareBank 1 Nord Norge (or short SNN) is headquartered in the city of Tromsø and ha s75 branches throughout Northern Norway. Other than a significant retail banking presence, the main industries are fisheries, oil and gas exploration and production moving north, mining and minerals, construction and tourism. The public sector is also a meaningful employer in this part of Norway.

Trøndelag is a geographical region in the central part of Norway, consisting of the two counties Nord-Trøndelag and Sør-Trøndelag. The region is, together with Møre og Romsdal, part of a larger administrative division called Central Norway. The population in these three counties is nearly 700,000 people or 13.8% of the Norwegian total as of June 30, 2013. Trondheim is Norway’s third largest city after Oslo and Bergen, and has played a key role in Norwegian history. Today the Norwegian University of Science and Technology is located here. SpareBank 1 Midt Norge (or short SMN) is based in the town of Trondheim and over 50 branches are maintained throughout the region. SMN is the region’s leading retail bank by market share. Within the corporate sector the most important activities of the bank is in commercial real estate, transportation and related services, maritime and offshore, seafarming, agriculture and forestry as well as other traditional manufacturing, construction and leisure industries.

Western Norway is the region along the Atlantic coast of southern Norway. It consists of the counties Rogaland, Hordaland, Sogn og Fjordane, and Møre og Romsdal and the region has a population of approximately 1.3 million people. The largest city is Bergen, second largest is Stavanger. The area shares a common history with Denmark, the Faroe Islands and Iceland and to a lesser extent the Netherlands, Scotland and England. Western Norway has also had a large emigration to the United States, Canada, Iceland, the Faroe Islands and the United Kingdom. On the other hand, thousands of Western Norwegians are descendants of Dutch and German traders who arrived in the 16th and the 17th centuries, especially in Bergen. Western Norway has the lowest unemployment rates, fewest people on welfare and the most innovative economy in the country. Southern Norway is the name of the geographical region of the Skagerrak coast of southern Norway consisting of the two counties of Vest-Agder and Aust-Agder. If defined as an informal region, Southern Norway is perhaps more properly defined as the Skagerrak coastal belt, thus excluding the inland valleys to the north. SpareBank 1 SR-Bank (short SR-Bank)’s home market are both in the Western and Southern Norwegian regions. The bank, which home base is in Stavanger and is Norway’s 2nd largest Norwegian owned bank, maintains approximately 50 branches in its region. Approximately 24% of Norway’s population live in the region, and it is also here that population growth is particularly strong. The dominating industry is oil and gas, but the region is also an important food producer and in Stavanger, finance and investments has also become a significant factor. The bank maintains the largest market share in the retail segment of all banks active in the region. Within the corporate segment, the largest exposures are to commercial real estate, service based businesses, pipelines and other transportation, agriculture and forestry, hydroelectric power, construction, minerals and mining.

Eastern Norway is the geographical region of the south-eastern part of Norway. It consists of the counties Telemark, Vestfold, Østfold, Akershus, Oslo, Buskerud, Oppland and Hedmark. Eastern Norway is by far the most populous region of Norway with approximately 50% of the overall Norwegian population. It also contains Oslo, which is both a county and a municipality. Oslo is Norway's most populous city by far and is its capital, and also the financial centre of the country. In Oslo and the surrounding region, the SpareBank 1 Alliance is represented by SpareBank 1 Oslo Akershus which maintains 18 branches. The largest shareholder of SpareBank 1 Oslo Akerhus is Sparebanken Hedmark, the fourth largest SpareBank 1 Alliance member bank (40.5% of the shares, with other SpareBank 1 banks owning approximately 20% of the shares). The main business area for SpareBank 1 Oslo Akershus is retail and mortgage lending. Sparebanken Hedmark is headquartered in Hamar, to the north of the capital, and it maintains 28 bank branches. Sparebanken Hedmark (A2 rated by Moody’s) is the only one of the large SpareBank 1 Alliance banks without equity certificates issued on the Oslo stock exchange, it is therefore a fully self-owned savings bank. The retail-corporate mix is approximately 30-70%, and within the corporate sector it is commercial mortgages, agriculture and service industries which are the largest components. Samarbeidende Sparebanker (short Samspar) is a group of 11 smaller savings banks in Eastern Norway which collectively joined the SpareBank 1 Alliance shortly after its formation in 1996. These banks are also predominantly retail (mortgage) banks with some SME corporate exposure, including commercial mortgages. The Samspar group of savings banks were 19 when they first joined the SpareBank 1 Alliance, but due to mergers have reduced their numbers to 11 (in 2013). The group represents approximately 20% of the assets of the SpareBank 1 Alliance and these banks are not rated by the major credit rating agencies.

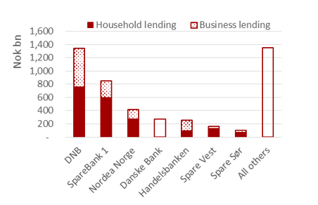

The SpareBank 1 Alliance banks cover the whole country with their presence. The focus of the SpareBank 1 banks is primarily on retail (mortgage) lending which makes up approximately two thirds of the aggregated SpareBank 1 balance sheet. The remainder of the loan volume is outstanding with diversified Norwegian small and medium sized enterprises, and for commercial mortgages.

The map of Norway illustrates the geographical presence of the alliance banks where the dots symbolize the branches of the Alliance Banks. SpareBank 1 has the broadest physical branch coverage of any of the banks or banking groups in Norway, which is reflected in a broad distribution of the residential mortgage assets in the cover bond issuer’s cover pool. The SpareBank 1 Alliance banks are close their customers and in addition operates an award winning internet banking platform.

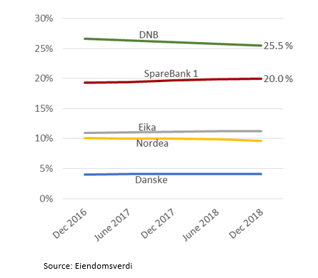

Market shares have grown slowly over the years

The SpareBank 1 Alliance is a banking and product alliance. By participating in it, the independent and locally anchored banks are all linked to and cooperate with each other. In this way, we combine efficient operations and economies of scale with the benefit of being close to our local customers and their local markets. The Alliance model has served the banks well.

In the regions where the largest banks are domiciled, market shares range between 30 to 50% in retail lending and deposits. The same market share applies to the local banks in our local districts. Nationally, due to an underrepresentation in Oslo and surrounding areas where a concentration of the population resides, the market share in residential mortgages is approximately 20%.

The SpareBank 1 Alliance is the second largest lender by assets in Norway. The following chart shows the outstanding balances in retail lending as of year-end 2018 for the largest banks.

The member banks in the alliance work in part through common projects and in part through the jointly owned holding company SpareBank 1 Gruppen AS.

SpareBank 1 Gruppen AS is owned by SpareBank 1 Nord-Norge (19.5%), SpareBank 1 SMN (19.5%), SpareBank 1 SR-Bank (19.5%) and Sparebank 1 Østlandet (12%), Samarbeidende Sparebanker AS (the group of smaller SpareBank 1 banks, 19.5%) and the Norwegian Confederation of Trade Unions (LO) and affiliated trade unions (10%).

The SpareBank 1 Alliance currently, as at 31/12/2018, consists of 14 independent banks. The largest banks in the Alliance are:

There are 10 smaller banks:

BN Bank ASA is another bank jointly owned by the Alliance banks.

Please find below the direct links to the investor relations pages in English for the four largest SpareBank 1 Boligkreditt parent banks. These banks are rated by Moody's (A2) and Fitch (A and A-) and represent approximately 80% of the total assets of the SpareBank 1 Alliance as a whole.

| Sr. Unsec. Ratings | Fitch | Moody’s |

|---|---|---|

| SpareBank 1 SMN | A- / F2 | A1 / P-1 |

| SpareBank 1 SR-Bank | A- / F2 | A1 / P-1 |

| SpareBank 1 Nord-Norge | A / F1 | A1 / P-1 |

| Sparebank 1 Østlandet | n/a | A1 / P-1 |

SpareBank 1 Naeringskreditt (Spacom) is a covered bond issuer and a sister company to SpareBank 1 Boligkreditt (Spabol).